This quarters edition of

Generational Information Newsletter

Generational Planning Group, we provide expert guidance to help you manage your financial future with confidence. Explore our resources and take control of your financial well-being today.

Chairman's Chat

Bearing in mind the changes in the 2024 budget, you will see the need for advice on this and all other generational planning is now paramount. Given that 43% of all the money invested in the UK is in pension funds, it is not surprising that the Chancellor decided that this is a place for future growth in the Exchequer’s Coffers!

Over the next 30 years, £5 trillion of assets will pass over to the next generation; this is the largest wealth transfer in UK history. Obviously, HMRC see this as a significant potential source of tax revenue into the Exchequer and for this reason I suspect we will see further changes in taxation on wealth transfers and generational planning.

Thankfully, there are still plenty of legal ways to deal with the taxation that arises when we move assets from one generation to the next, but it is crucial that any such planning remains HMRC compliant.

Our main aim at Generational Planning Group (GPG) is to help design legal and tax efficient ways to achieve effective IHT mitigation. In particular, the use of trust planning is going to become very important as the new rules come in. We have been dealing in this area for over 35 years and now consider it to be our main specialism.

Explore Our Services

Topical articles for your pursual, some food for thought

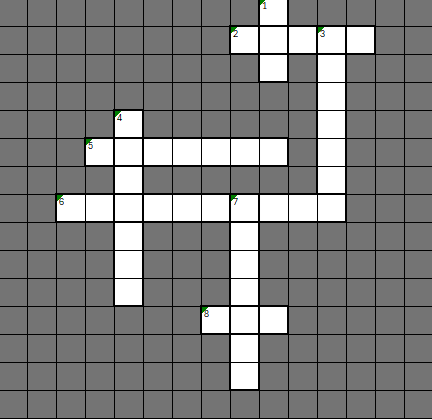

Cryptic Finance Crossword

Challenge Your Financial Acumen

Standard

2. Interest or Mortgage (5)

5. Economic theme with a play on debt/credit (7)

6. A stretch but fair in the financial lingo (5,4)

8. Money owed to HMRC (3)

Down:

1. The top has fallen off the leaning tower – it can be saved (3)

3. One financial, one surface reading as excuse (7)

4. Anagram of “nip one s” (7)

7. Get back what’s been wrongly tax (7)

Cryptic

1. The top has fallen off the leaning tower – it can be saved (3)

3. One financial, one surface reading as excuse (7)

4. Anagram of “nip one s” (7)

7. Get back what’s been wrongly tax (7)

Explore the Family Forum with Our Chairman

Book your appointment now for a Family Forum

Discover our upcoming events !

Disclaimer: This e-mail is intended solely for the above-mentioned recipient, and it may contain confidential or privileged information. If you have received it in error, please notify us immediately and delete the e-mail. You must not copy, distribute, and disclose or take any action in reliance on it. This e-mail message and any attached files have been scanned for the presence of computer viruses. However, you are advised that you open any attachments at your own risk.